The House has just released their new tax bill, a plan that the NY Times calls the most sweeping tax rewrite in decades.

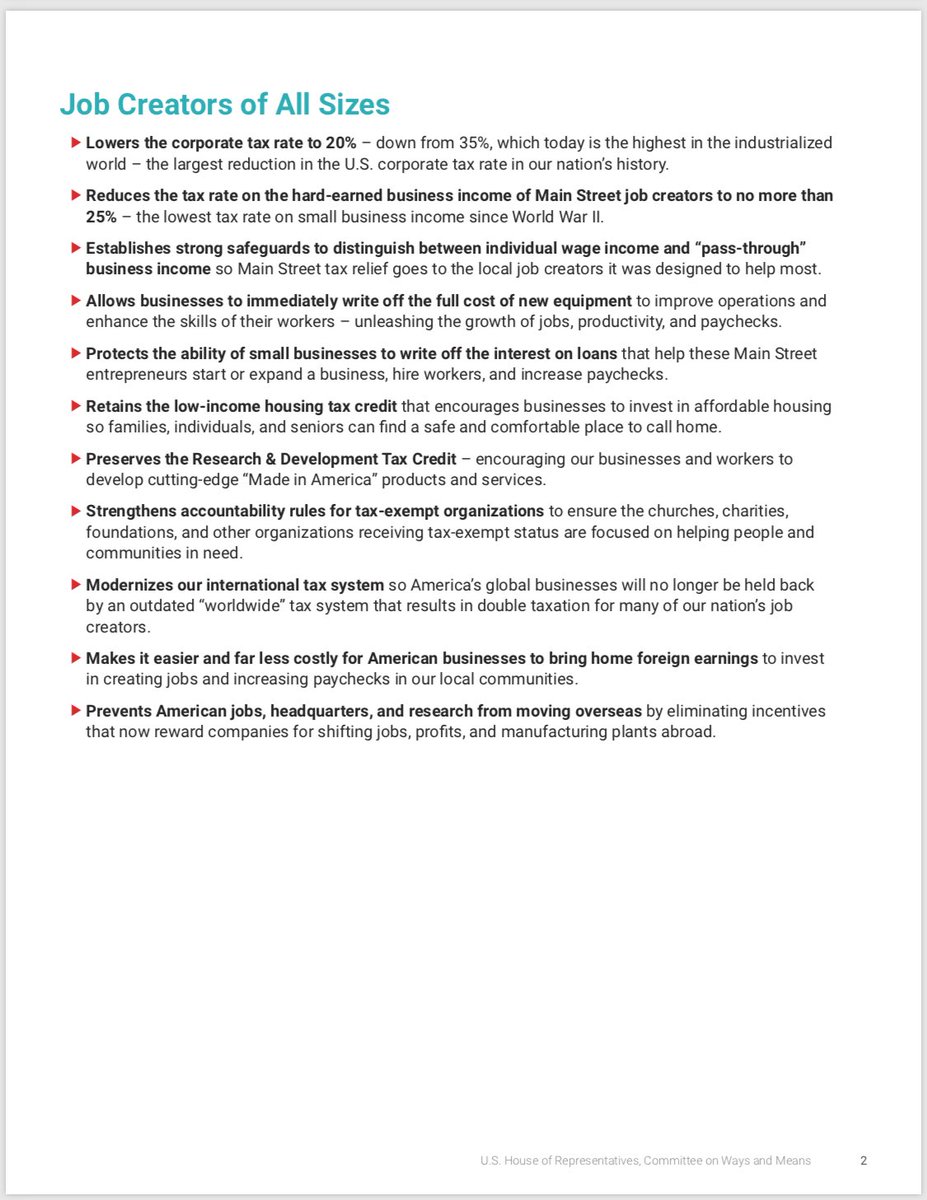

Here’s the policy highlights put out by the House Ways and Means committee (click to enlarge):

UPDATE:

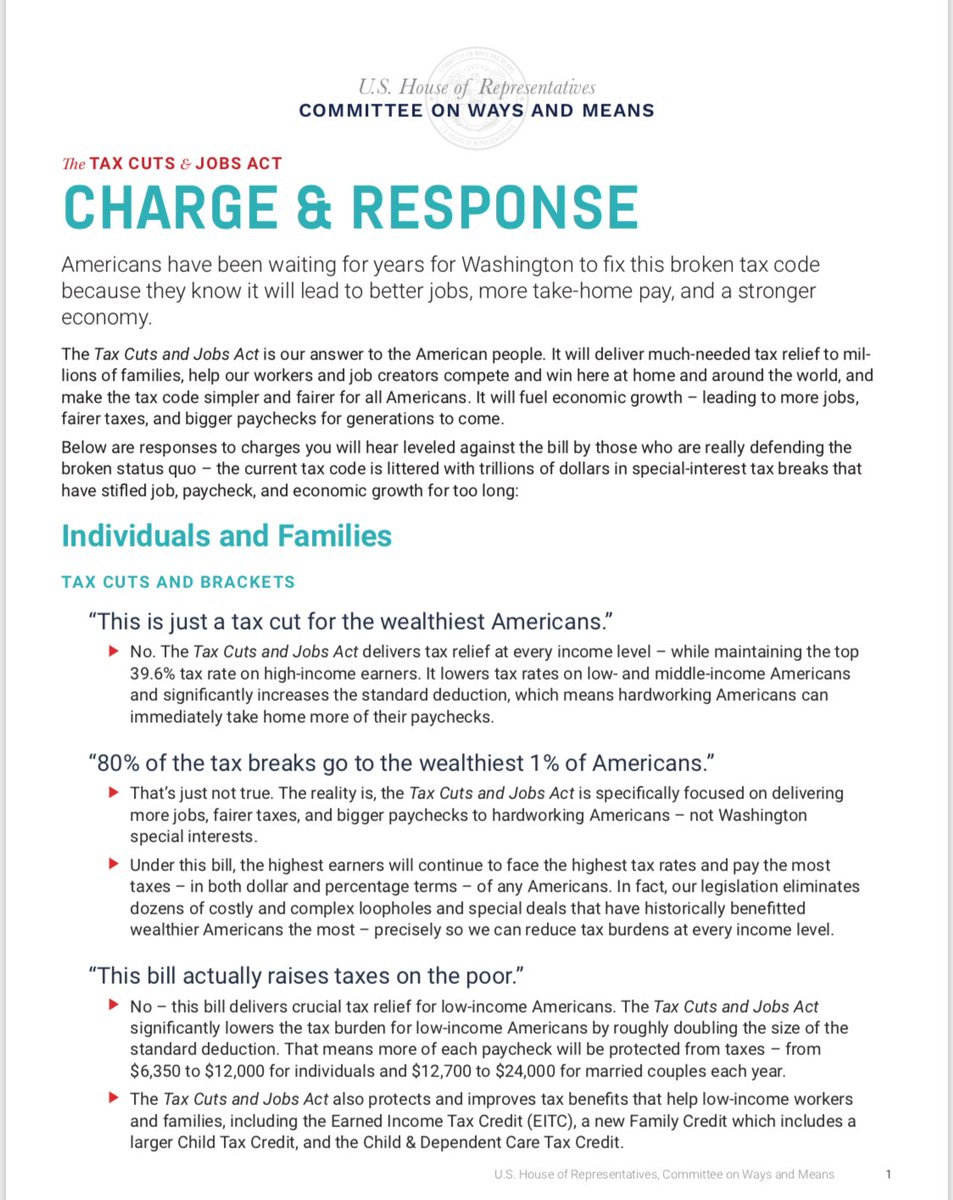

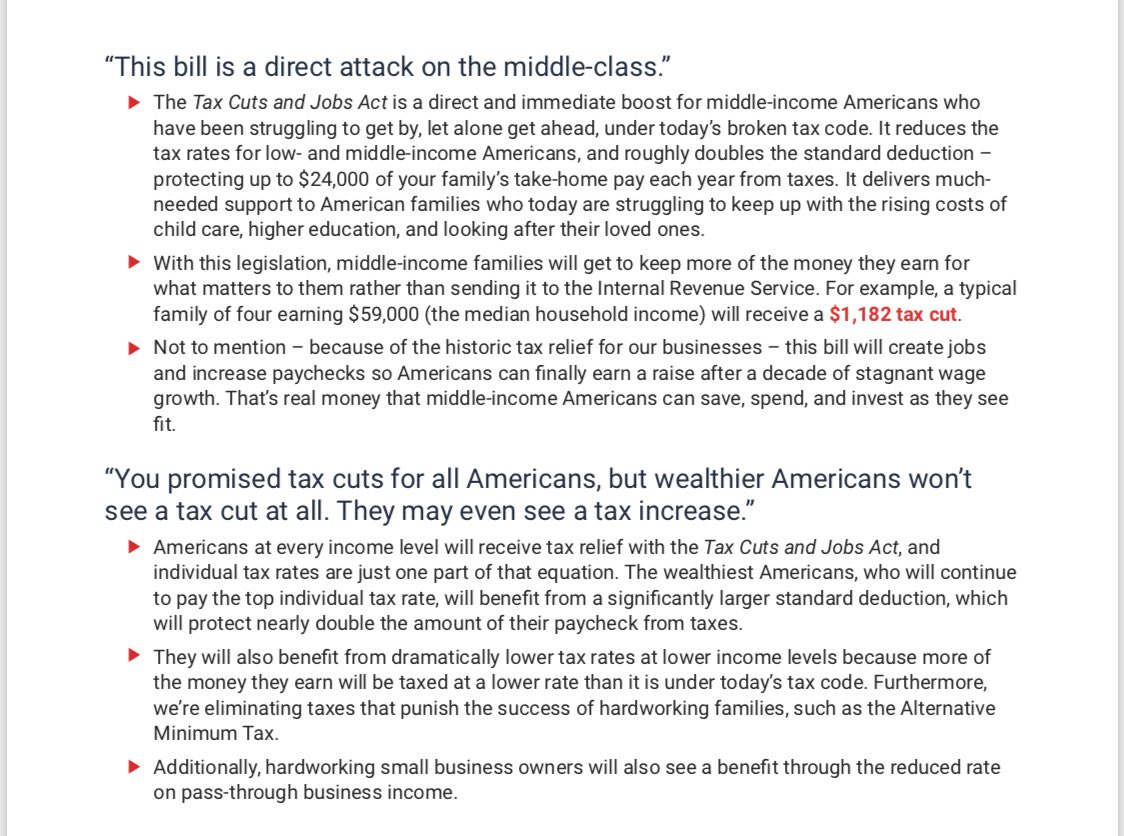

Here’s the ‘Charge and Response’ talking points that Republicans released with their new tax plan:

And if you’re interested, here’s what the NY Times had to say about the plan:

Republican lawmakers are unveiling the most sweeping rewrite of the tax code in decades, outlining a plan to cut taxes for corporations, reduce them for middle-class families and tilt the United States closer, but not entirely, toward the kind of tax system long championed by businesses, according to talking points circulated on Thursday.

The bill, released after weeks of internal debate, conflict and delay, is far from final and will ignite a legislative and lobbying fight as Democrats, business groups and other special interests tear into the text ahead of a Republican sprint to get the legislation passed and to President Trump’s desk by Christmas.

The bill keeps a top rate of 39.6 percent for the highest-earners and roughly doubles the standard deduction for middle class families. It expands the child tax credit to $1,600 from $1,000 and will not make any changes to the 401(k) plans. It does propose changes to the popular mortgage interest deduction. Under the Republican plan, existing homeowners can keep their mortgage interest deduction but future purchases will be capped at $500,000. The bill cuts the corporate tax rate to 20 percent, from 35 percent.

According to the talking points, the bill “makes no changes to the popular retirement savings options that Americans have today — including 401 (k)s and Individual Retirement Accounts, or I.R.A.s. Americans will be able to continuing making both traditional, pretax contributions and ‘Roth’ contributions in the way that works best for them.”

One of the biggest flash points will be how the bill treats the state and local tax deduction, which lawmakers are proposing to cap at $10,000. That will not be enough for Republicans in some high-tax states, where middle-class families make heavy use of the deduction.

The compromise, as it had been sketched out this week, would preserve the deduction for property taxes, but not for state and local income taxes, and it appeared as if there would be a cap on the deduction. But at first glance, it did not appear as if that was enough to win over all of the New York and New Jersey members.

As always you can expect this to be heralded by the media and Democrats as a tax cut. Buckle up.