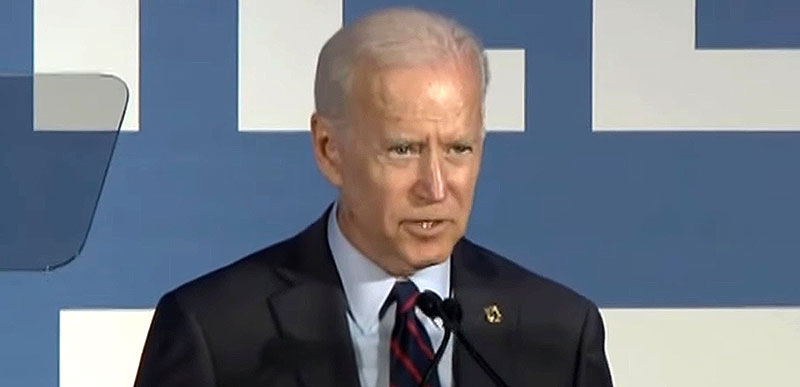

Politico has an article today about a study that claims Joe Biden’s tax proposal will raise an additional 4 trillion dollars over a decade and they make it sound great!

Tax proposals by Democratic presidential contender Joe Biden would raise about $4 trillion over a decade, largely due to increased rates on high-income households and businesses, according to a new Tax Policy Center analysis.

“Four big-ticket items account for about 80 percent of the revenue gain,” said Gordon Mermin, senior research associate at the nonpartisan group.

Among them, the former vice president’s plan would generate about $1.3 trillion by boosting the corporate income tax rate to 28 percent from its current level of 21 percent. Another $962 billion would come from applying Social Security taxes to earnings above $400,000.

In addition, higher capital gains and dividend taxes would raise about $448 billion under two changes Biden has floated. He would tax such earnings the same as ordinary income for taxpayers with incomes exceeding $1 million, and tax unrealized capital gains of more than $100,000 at death unless left to a surviving spouse or donated to charity.

Biden’s plan would also produce about $432 billion by repealing income tax reductions from 2017’s Tax Cuts and Jobs Act for taxpayers with incomes above $400,000. He would restore their top individual tax rate to 39.6 percent, limit their itemized deductions and phase out business income deductions they get.

Got that? Biden’s plan will only raise the corporate tax rate which will make America less competitive and will send more jobs overseas. But Politico doesn’t mention that.

And in raising taxes on the rich and repealing the 2017 tax cuts, they are increasing taxes on job creators which will also hurt job growth. But who needs a great unemployment rate? They don’t mention this either. They don’t mention any effects on the economy whatsoever.

Overall, the Biden plan is “very progressive” even though taxes would climb on all income groups on average, Mermin said.

The distribution skews heavily toward those with higher income, with a 17 percent average tax increase on the top 1 percent and more than 23 percent for the top 0.1 percent. The top 20 percent would bear almost 93 percent of the tax increases.

In contrast, no quintile in the bottom 80 percent would see an average tax increase of more than 0.5 percent, with nearly all of the higher tax burden resulting from indirect effects of increased corporate income taxes.

You can vote for this! The tax increases will barely affect most people as the richie rich types bear most of the brunt. Doesn’t that sound swell?

Seriously now, have you ever seen a write-up this nice from the MSM for a Republican tax proposal? I haven’t and I’ve been doing this for a long time. It’s always the same old crap from the media, saying ‘how you gonna pay for those tax cuts’ and ‘it won’t raise the money you say it will’. But I guess Biden and his gaffe-tastic campaign need all the help they can get, right?