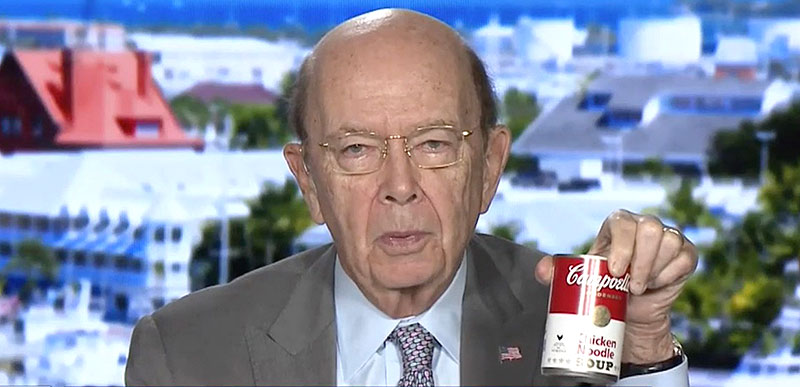

According to Trump’s Commerce Secretary Wilbur Ross, the price increases caused by their steel tariffs will be only be trivial. So nothing to worry about:

Holding up a can of Campbell’s soup, Ross argued that “there are about 2.6 pennies worth of steel. So if that goes up by 25 percent, that’s about six-tenths of one cent on the price on a can of Campbell Soup…All this hysteria is a lot to do about nothing.”

Why tariffs are needed: “The reason we’ve had to go this route is because the conventional trade methods don’t solve the problem of global overcapacity and global dumping. You put a tariff on it coming from one country, they try to ship it through another one. It has to be broad, it has to be global in its reach in order to solve the fundamental problem.”

Fears of retaliation: “I think this is scare tactics by the people who want the status quo, the people who have given away jobs in this country, who have left us with an enormous trade deficit, and one that’s growing. It grew again last year, and if we don’t do something, it will keep growing and keep destroying American jobs.”

I”ve mentioned this twice already today, but it’s worth mentioning again. Just how trivial was Trump’s lumber tariff increase?

““We’re in a lumber supply crisis,” said Stinson Dean, a Kansas City lumber broker, in an analyst note to investors. “None of us have experienced a market like this.” The other side of the equation is supply, which has been cramped by the 20.83% average tariff imposed on Canadian lumber imports by the Trump administration starting in November 2017, but retroactive to January.”

For sure, the lumber market is suffering from several different problems, whether it be wildfires or beetles. But Trump’s tariff on Canadian lumber has helped propel the lumber industry into a crisis, where prices are higher than they’ve ever been:

Lumber prices are the highest they’ve ever been in the United States—let that sink in for a moment. Futures contracts for 1,000 board feet of lumber are trading at $513. For perspective, according to Wood Markets, in the 1980s it was rare for average monthly prices to exceed $200 (it only happened in 14 months that decade); in the 1990s, U.S. prices managed to crack $400 for 14 months that decade; in the 2000s, the housing crisis put downward pressure on lumber prices, which only broke $400 8 months that decade, and dropped under $200 for 11 months.

Ted Ostranger, a market manager for 84 Lumber, said, “Usually prices drop in January. This year is a different scenario, and most people are shocked by the fact the lumber market is not coming off any this year.”

So ya’ll remember what Wilbur Ross said when Trump’s trade war on steel and aluminum gets going in full gear and prices begin to rise substantially.