Bad news. The fed has emptied out its clip of financial solutions. It has dropped interest rates to zero and tossed another $700 billion into the market:

The Federal Reserve, saying “the coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” cut interest rates to essentially zero on Sunday and launched a massive $700 billion quantitative easing program to shelter the economy from the effects of the virus.

The new fed funds rate, used as a benchmark both for short-term lending for financial institutions and as a peg to many consume rates, will now be targeted at 0%-0.25% down from a target range of 1% to 1.25%.

Facing highly disrupted financial markets, the Fed also slashed the rate of emergency lending at the discount window for banks by 125 bps to 0.25%, and lengthened the term of loans to 90 days.

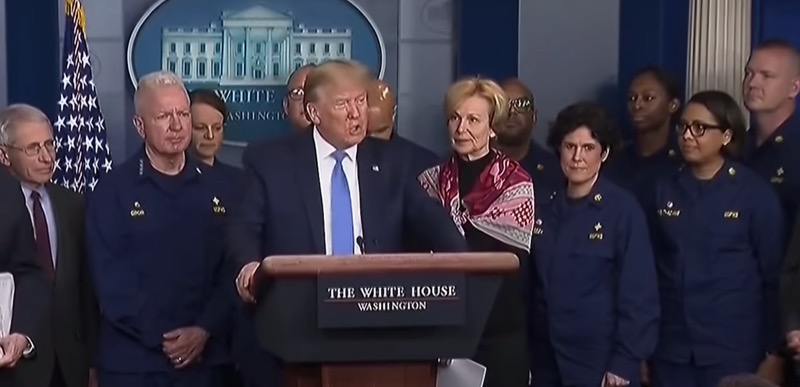

Here’s Trump saying he’s very happy the Fed dropped the rates:

He has complained before that the rate was too high.

At 6pm EST, the Dow Jones futures market opened up at a huge loss:

https://twitter.com/crofin67/status/1239312314446360576There’s a lot of volatility right now, it could change by Monday when the market opens, but as of now, it’s not good at all….